Are you planning to import a mobile phone to Pakistan? Then remember that you have to pay taxes to get it running in Pakistan.

Taxes are increasing day by day due to the increase in imported goods. The government of Pakistan presented a new budget to impose new taxes on imported mobile phones. PTA tax is the tax imposed on every product imported into Pakistan.

Mainly if you import mobile phones from any other country to Pakistan, you have to pay PTA tax; otherwise, your mobile phone device will get blocked. PTA assigns tax according to the model, brand, and type of mobile phone. Federal board of revenue (FBR) placed 6 tax slabs on importing mobiles.

If you are going to import or have imported a mobile phone to Pakistan, and now don’t know how much tax you have to pay and what will be the process to pay? Then you are at the right place. Here is a complete key to knowing and paying your mobile tax.

How To Check PTA Mobile Tax Online?

The people who like to purchase mobile phones from abroad must pay PTA tax first to access their mobile phones. After getting a mobile phone at the airport, you must pay tax at the counter. But before paying the tax, knowing how much you have to pay is essential.

Online PTA mobile tax checking is not challenging; you must follow a few steps. Here are two simple steps to learn about your mobile tax online.

1. Through SMS

The easiest way to check PTA tax is by using an SMS service. You will learn about the whole tax in just a few minutes. Here is the complete procedure to help you know your PTA mobile tax.

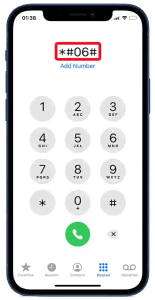

First of all, open the dialer on your phone.

First of all, open the dialer on your phone.- In the dialer, you have to dial *#06#; you will get a 15-digit IMEI number.

- When you get that IMEI number, send it to 8484 through message.

- After a few minutes, you will get a message with complete detail of your PTA mobile tax.

2. By Using The DIRBS Website

Using the DIRBS website is another method to know your PTA mobile tax. It is also the most straightforward method to check. You have to follow the complete procedure to know the tax of your mobile.

Open the DIRBS website and then send your device IMEI number there.

Open the DIRBS website and then send your device IMEI number there.- After a few seconds, you will receive a message from a website.

- You may get a message of this type; your device has been approved and compliant by PTA, and now you can enjoy all network services.

Or this type of message:

- Your device is not approved, but still, you can use and enjoy all networks. To approve your device, send a message to PTA.

Or this type of message:

- You cannot use this device in Pakistan because it is blocked. You have to pay PTA taxes to use this device in Pakistan.

These are the quickest PTA mobile registration tax check online methods. If you receive any message that your device is blocked, then you have to register your device by paying taxes to PTA. Here is the complete guideline for registering your device by paying taxes.

PTA Mobile Registration Tax Details

If your device is compliant, you do not need to pay taxes for your mobile phone. If you receive a message that your device is blocked and not approved, then you must be you have to pay PTA taxes to use it in Pakistan.

You can pay taxes to any bank account, but if you do not want to share there, then there are three easy methods to pay taxes:

- By Using Dial Code

- Through Mobile Application

- By using DIRBS Website

1. By Using Dial Code

Open the phone dialer of your mobile, and dial *8484#.

Open the phone dialer of your mobile, and dial *8484#.- Different menus appear on the screen; select 1 for registration.

- Pakistanis have to choose 1, while foreigners have to choose 2.

- You will not pay tax if you have device no.1; if you have a different device, then pay tax in any bank branch.

- Enter your CNIC and passport number; then, you must enter the network number you use.

- Now provide your device’s IMEI number; you must enter both IMEIs numbers if you have a dual sim mobile phone.

- In the end, enter 1 to complete the process of registration.

2. By Using Mobile Application

To register your mobile by using a mobile application, follow the given instructions carefully:

- First, unlock your mobile phone and then go to the App store or Play store application.

- Search the PTA app, and click on the install option to download it.

- After installing the application, open it and enter the IMEI number of your device.

- Your mobile will get registered.

3. Through The DIRBS Website

To register your mobile through the DIRBS website, follow the given instructions:

Open the DIRBS website and sign up by giving all the essential information for creating an account.

Open the DIRBS website and sign up by giving all the essential information for creating an account.- If you already have an account there, then sign in.

- When a new window appears on your screen, click apply for COC.

- Provide your contact and IMEI number.

- Now you will get a message from PTA; they will ensure that you have paid the taxes on your mobile.

- All the information will show in my application option; go there and check it.

What’s Next?

Once you check the details of your PTA tax online or any other method listed above, it’s time to pay PTA mobile tax. Getting information about the tax is necessary, and paying tax ensures that you timely register your device with the PTA using DIRBS.

Final Words

People who want to import mobile phones from abroad must know about PTA taxes and all information about registering their new mobile. In this article, you will get all the information about PTA taxes and how you can know the amount of tax on your mobile.

Registering your mobile in the country where you live is very necessary; if you do not do it, your device will get blocked. So, to register your mobile after importing, follow the procedure described in this article to reduce your worries.

Follow the procedure carefully and enjoy your brand-new mobiles. Don’t forget to give us your feedback.